KBA: China Rally – Could A-Shares Have More Room to Run?

China was due for a week-long vacation in the first week of October: The National Holiday, also referred to as "Golden Week". However, this year's Golden Week sparked an unusual reaction: people felt it was too long! Why? They wanted to buy stocks.

The Shanghai and Shenzhen stock exchanges closed for the break right after China's markets surged on optimism surrounding the announcement of a stronger-than-expected stimulus package for both the economy and the capital markets on September 24th, 2024.

Mainland investors, caught just before the holiday break, experienced shock and then FOMO (fear of missing out) as they watched the offshore market take off while the domestic market remained closed for the holiday. Hong Kong's Hang Seng Index was up over +6% on October 2nd, the first of four trading days in which Hong Kong was open while Mainland exchanges were closed.1

These Mainland investors tend to focus on China’s domestic Shanghai and Shenzhen stock markets (China A-shares) and invest through local brokers. To cope with the surge in demand, 60 brokerage firms extended their services to 24/7 over the holiday week.2 Over the course of the week, these firms reported a 3x increase in account openings, as many Gen Z investors reportedly opened their first brokerage accounts, and a 6x increase in password resetting services, as older investors accessed accounts that had been left untouched for years.2

Offshore China stocks, especially the internet companies held in the KraneShares CSI China Internet ETF (Ticker: KWEB) caught the attention of global investors during this period. In particular, David Tepper of Appaloosa Management told CNBC he was bullish on China stocks8 after a 13F filing revealed his firm had sold Nvidia and bought China Internet stocks.9

Since the rally began, over $10 Billion has gone into US-listed Chinese ETFs with KWEB accounting for a significant portion of the flow.1 However, for investors who only access China through the offshore market (US listed American Depositary Receipts and Hong Kong-listed stocks), they may be missing another core component of the rally: onshore China (A-Shares).

We believe China's equity markets could continue to trade on policy indications, though onshore and offshore investors often interpret policy differently. For example, A-shares reacted positively to the Ministry of Finance's (MOF) press conference on October 12th, which included significant spending and deficit expansion commitments to real estate developers and local governments, while offshore markets sold off in the following trading day. Likewise, we could see similarly disparate reactions to announcements expected from the National People's Congress (NPC) in the coming weeks. The NPC is likely the only body that will make a determination on payments to consumers. While offshore listings benefit from downstream policy impacts, onshore listings are direct beneficiaries of stimulus and fiscal spending.

In addition to KWEB, KraneShares has a suite of ETFs that provide global investors access to the China A-share market, including the KraneShares Bosera MSCI China A 50 Connect Index ETF (ticker: KBA). KBA is the first MSCI-linked China A-share ETF to be listed in the US.2 KBA focuses on the 50 largest, most liquid, and most internationally accessible A-share stocks, according to MSCI’s definition.

Have we seen this before?

The Shanghai Composite increased by over 4X during the 2005-2007 rally and 2X during the 2015-2016 rally. These rallies lasted over 600 days and approximately 180 days, respectively.

Could 2024-2025 Mimic Previous Chinese Stock Market Rallies?

The current surge in China's stock markets, spurred by government stimulus and retail enthusiasm, bears similarities to past rallies in 2005-2007 and 2014-2015. While history often provides valuable lessons, this rally has both familiar and unique elements.

What’s Similar This Time:

Government Policy ("Bazooka" Stimulus)

The Chinese government’s recent large-scale stimulus is reminiscent of previous policy-driven market boosts. This type of intervention is a common factor behind the country's major stock market rallies.

Strong Stock Performance in a Short Period

Just as in 2005-2007 and 2014-2015, stocks are experiencing a rapid rally. Major indices have surged, fueled by government actions, economic optimism, and foreign interest.

Retail Frenzy

The surge in brokerage account openings mirrors past trends where retail investors played a significant role. In 2015, loose regulations allowed for high levels of leverage, driving stock prices up, and this time, the fast-growing retail base is poised to contribute to market momentum, but this time there are key differences.

What’s Different This Time:

Historically Low Positioning

One significant factor distinguishing the current upswing is the historically low positioning of both domestic and foreign investors prior to this surge. In the years leading up to this rally, investor sentiment toward China had been dampened by a combination of regulatory crackdowns, geopolitical concerns, and slower economic growth. This meant that many investors were underweight in Chinese stocks, leaving ample room for capital reallocation into the market as optimism and confidence return. As a result, the market rally is being driven not only by stimulus but also by a catch-up effect, where investors are increasing their exposure to China after a prolonged period of cautious positioning. At the same time, the fragility of investor sentiment towards China can also lead to heightened volatility in the short term.

Less Leverage

An element of previous boom-and-bust cycles was the high levels of leverage employed by stock investors. Since 2015, regulators have tightened the margin available to retail investors.3 This could mean that the current rally is more sustainable than in the past.

Unprecedented Central Bank Support

The People's Bank of China (PBOC) has extended an RMB 500 billion swap facility to major financial institutions to fund their stock purchases. This is an unprecedented move that ensures ample liquidity for institutional stock purchases. PBOC Governor Pan Gongsheng has said that the bank will also roll out two additional tranches of the swap program, as deemed necessary.4

Investment Opportunities:

KBA: The Top 50 China A-Shares by Market Cap, Liquidity, and International Accessibility

This ETF focuses on the top 50 China A-shares that are widely followed by institutional and retail investors, offering exposure to high-quality companies. KBA provides a balanced approach for investors looking for a mix of stability and growth. MSCI created KBA’s index to track a concentrated basket of A-share names that global institutions and China's sovereign wealth fund focus on. Top holdings include CATL (the world’s largest battery maker that supplies most of the world’s leading electric vehicle manufacturers, including Tesla, Ford, BMW, Hyundai, Toyota, and more),5 Kweichow Moutai (one of China’s favorite luxury spirits brands),6 and BYD (the world’s largest electric vehicle manufacturer).7

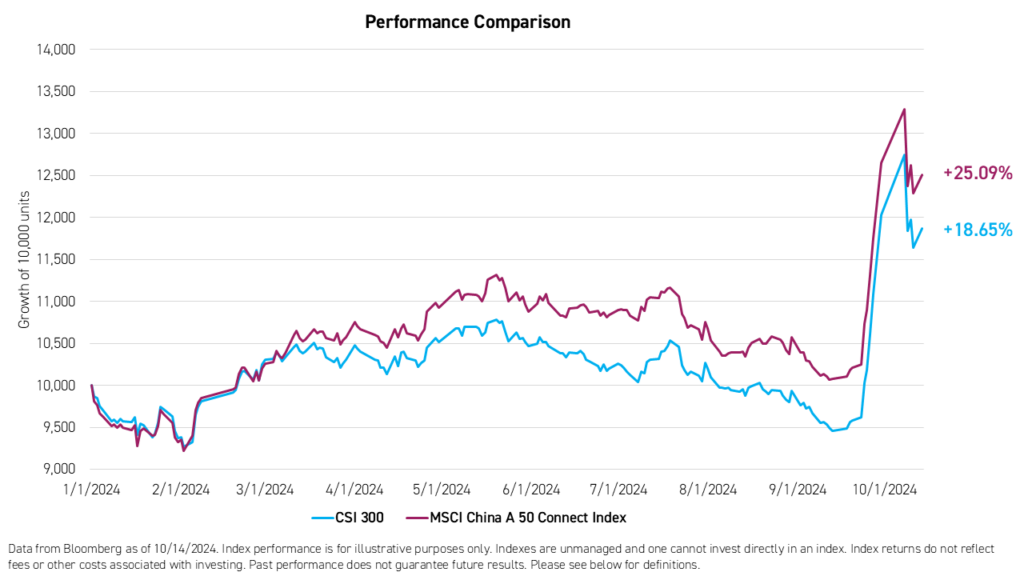

We believe this concentrated approach, focusing on the large cap stocks favored by Mainland investors and sovereign wealth funds, has led to the outperformance of the MSCI China A 50 Connect Index over the CSI 300 Index so far this year.

For KBA standard performance, top 10 holdings, risks, and other information, please click here.

KSTR: High-Beta China Onshore Technology Companies

KraneShares is the only asset manager outside of Mainland China to provide access to China’s STAR market, its famous venue for Tech and Innovative stocks to IPO domestically. The KraneShares SSE STAR Market 50 Index ETF (Ticker: KSTR) targets high beta onshore growth companies, often traded by domestic investors. KSTR offers investor higher potential returns but with increased volatility. STAR market has a 20% daily performance cap, which is double the 10% cap imposed on main board stocks.

For KSTR standard performance, top 10 holdings, risks, and other information, please click here.

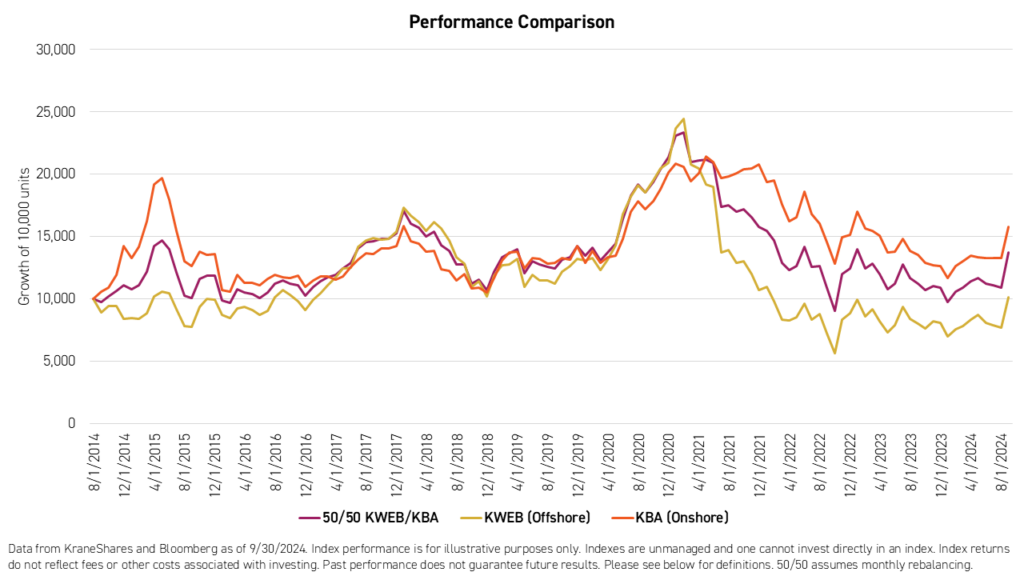

Long-Term China Allocation: Balancing Onshore & Offshore Exposure

We believe that a 50/50 split between offshore and onshore China equity offers a more balanced approach for global investors and may improve risk-adjusted returns over the long term. A-shares represent nearly 50% of the total China equity opportunity and have differentiated return and risk drivers compared to offshore stocks. However, A-shares make up only 14% of the MSCI China Index. Investors can implement this strategy using the KraneShares CSI China Internet ETF (Ticker: KWEB) to represent offshore and KBA to represent onshore.

Conclusion

The excitement surrounding China’s current stock market rally echoes previous periods of strong growth, driven by government policy and enthusiastic retail participation. As we have seen in the past, such rallies have the potential to deliver significant returns. However, investors should approach the market with a balanced perspective.

For investors looking to seize opportunities beyond KWEB, KraneShares offers other China ETFs, including KBA and KSTR, which provide access to high-quality companies and growth sectors within China’s onshore market, which could continue to catch up with the recent upswing in offshore China markets. History may not repeat itself exactly, but understanding the patterns and navigating with caution can lead to favorable potential outcomes.

Citations:

- Data from Bloomberg.

- "Feeling like opening an account during the holiday? More than 60 brokerage firms have stated that they will not be closed during the National Day holiday! Five major service measures are in place," Sina Finance. October 1, 2024.

- Cheng, Evelyn. "China's stock surge has echoes of the 2015 bubble. What's different this time," CNBC. October 1, 2024.

- Data from KraneShares, the People's Bank of China (PBOC), and Bloomberg as of 9/25/2024.

- Hawkins, Amy. "CATL, the little-known Chinese battery maker that has the US worried," The Guardian. March 18, 2024.

- Li, Rico. "What Makes Moutai the Lading Baijiu of China," Sotheby's. March 24, 2024.

- Yang, Zeyi. "Why the world's biggest EV maker is getting into shipping," MIT Technology Review. January 30, 2024.

- Gu, Jacob. "David Tepper Buys ‘Everything’ China-Related on Beijing Easing," Bloomberg. September 26, 2024.

- Williams, Sean. "Billionaire David Tepper Sold 84% of Appaloosa's In Nvidia and Is Piling Into This Historically Cheap Cyclical Stock," The Motley Fool. September 24, 2024.